If you are a business owner seeking a retirement funding opportunity, or evaluating your existing retirement plan, you are probably seeking your ultimate financial goal. We can help you choose a Small Business Retirement Plans right for you.

Accumulate, Preserve and Transfer Wealth

You have worked hard to achieve your financial standing. Now you want to reap the rewards of that financial success with a prudent, carefully planned strategy to help you achieve your financial goal.

But just how do you do that and is there a way to combine achieving your financial goals with reducing your current taxes?

75% of Americans indicate that they do not feel very confident that they are saving enough for retirement.

Could your business benefit from a customized business owned retirement plan?

The Challenge

The challenge as a small business owner is to determine what is the most beneficial way to build your assets both from an accumulation and a tax savings standpoint so they will be available to help you achieve your retirement goals.

A pension plan designed specifically for your business may be the solution.

The Choices

We offer a variety of plans to structure a retirement program to fit your needs, including:

- 401k Plans including Safe Harbor Plans

- Traditional Defined Benefit Plans

- 412 (e)(3) Defined Benefit Plans

- New Comparability Profit Sharing Plans

- And much more

Once you have chosen the type of plan, you can choose the plan features that meet your specific requirements. These features include:

- Eligibility Requirements

- Vesting Schedule

- Loan Provisions

Innovative designs can be structured for either a new retirement program or a takeover of an existing plan. To complement this plan design package we offer a full administrative package as well as customer focused service, technology support and a wide range of funding options.

New Comparability Profit Sharing Plans

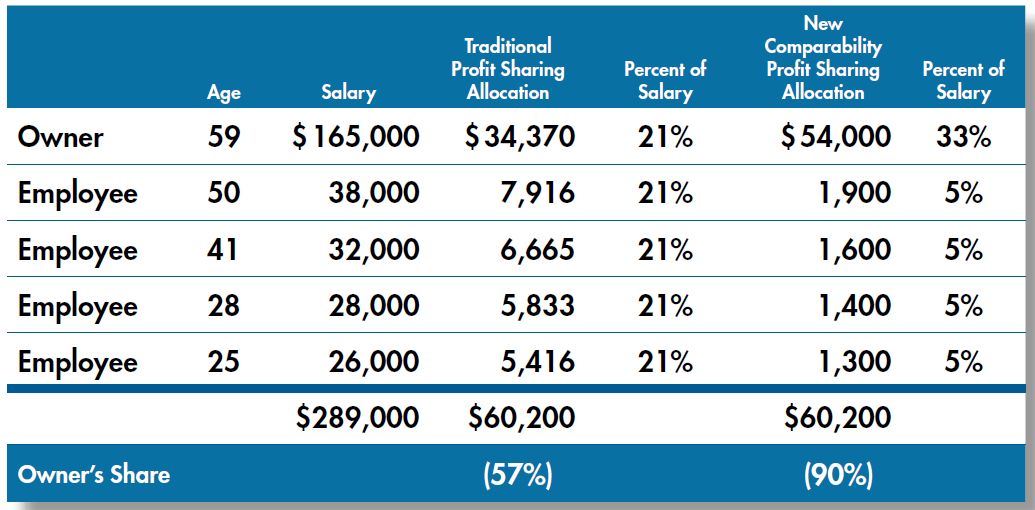

The plan works best when the business owner is older than most of the other employees.

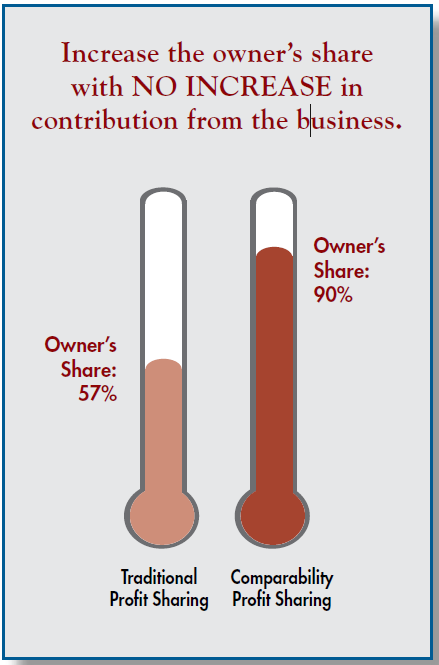

These plans allow for the largest possible share of the company’s contribution to be allocated to the owner and/or key employees. There is flexibility in the contribution level since it is a profit sharing plan and the contribution each year is discretionary.

Below is a hypothetical comparison illustrating the power of the New Comparability Plan. Note how the owner’s allocation has increased from $34,370 to $54,000. That is a 57% increase to the owner with no increase in the contribution from the business.

Safe Harbor 401k Plans

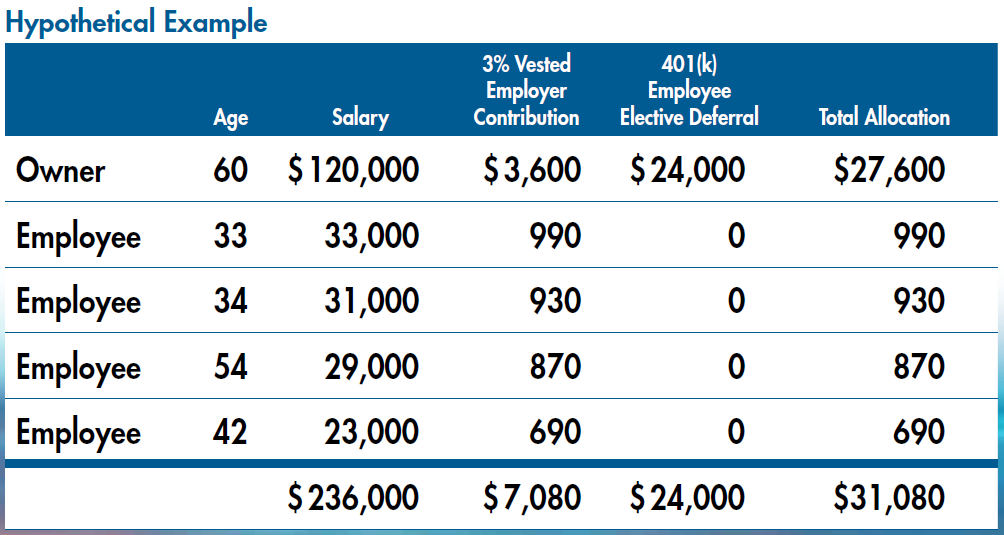

If you are a small business owner interested in a 401k plan you need to consider the advantages of a safe harbor 401k plan.

These plans allow the key employees to contribute up to the maximum dollar of $18,000 for 2017 as their 401k elective deferral without regard to what the other employees contribute. The maximum deferral for 2017 is $24,000 if a participant is age 50 or over.

In a traditional plan, the highly compensated employee’s contribution may be limited and it depended upon what all the other employees contribute as elective deferrals to the plan. One method of meeting the safe harbor rules is to make a 3% fully vested contribution for all employees. The end result can be a very appealing plan.

Owner Only 401k Plans

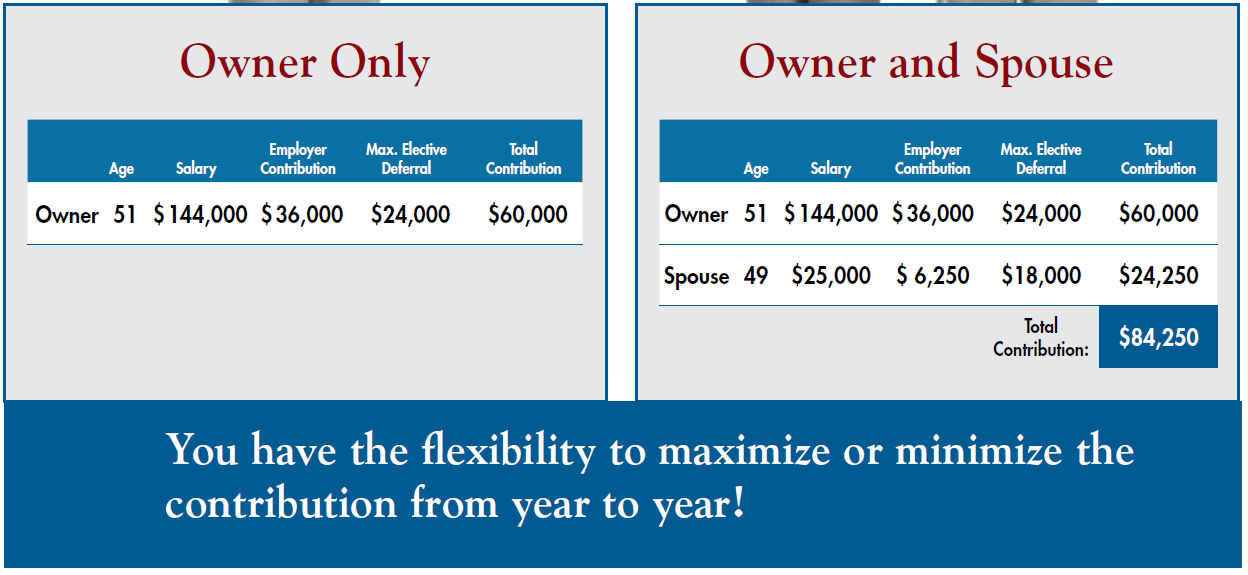

If you are a small business owner with no employees and are looking for complete flexibility, an owner only 401k Plan could be the solutions for you. This is not a new type of 401k plan. This is a traditional 401k plan with all the normal features of a 401k plan except that is covers a business where the only eligible employee is the owner or the owner and a spouse.

In this type of plan the business owner essentially wears two hats. You are the employee and employer. You can make contributions to the plan in both capacities.

A Customized Opportunity

Let us help you find a variation of these plan designs that could help you covert taxes to assets, defer tax payments and generate the retirement income you desire.

If you do not have a retirement plan or even if you do have an existing plan, you need to review the new plans created by recent tax law changes available for small business owners. Retirement plans are more flexible and appealing than ever before and there are numerous plan designs to choose from.

Retirement plans today may allow you, as the small business owner, to receive 60%, 70% or even more of the deductible business contribution. In such cases, it could be costing you money not having a plan.

But how do you know which type of plan is right for you? Allow us to give you a free look at the innovative retirement plans available today. You have the retirement goals. Let us help you achieve them.

Is it costing you money not having a plan? Find out with a free analysis today.

There is no cost for your retirement design proposal. Why wait?

We will work with you to help determine your individual needs, long term goals and objectives.

Each individual business owner has a unique set of needs and considerations. We take into account such issues as:

- Estate planning

- Current income

- Tax objectives

- Family business succession

- Transfer of wealth to the next generation

This initial discovery phase can help us determine which type of small business retirement plans may best meet your objectives. Once the plan type is chosen we can also recommend the best way to implement and administer the plan to meet your retirement needs.

From the plan design to product fulfillment to annual administration, we can handle the complete package to give you peace of mind. This will leave you to do what you do best- running and growing your business.

Our package includes:

- Plan Design

- Plan Documents

- Investment options from Fidelity, T Rowe Price and other well-known names

- Investment advice available through Morningstar for 401k plans

- Administration

- Daily Valuations and internet access for 401k plans

- Plan Funding

There is no fee for this discovery and design process. However, there could be a cost- the cost of continuing to pay taxes that could work for you and your small business in achieving your financial goals.

The next step is yours. All you need to do is complete a short confidential census and return it to us with your plan goals.

The important thing is to take that next step.

In defined contribution plans, the amount of funds accumulated and the investment gains or loses solely determine the benefit at retirement. You should refer to your retirement plan, adoption agreement or consult a tax advisor for more information about these distribution rules. Neither Summit nor its agents give tax advice. Clients should contact their attorney or tax advisor on their specific situation.